From the highs of 34 Golden Globe nominations to the lows of being downgraded at brokerages: Netflix is a tech-giant stuck between a rock and a hard place. With a debt of $12 billion, it’s easy to see why Wall Street’s Needham and Co. have hit the big red “sell” button and thrown gasoline onto what was once a dimly lit ember.

From a stock perspective, it’s doom and gloom for Netflix. Doom being the prediction that four million subscribers will be lost in 2020, and the gloom because that downgrade was done by a top analyst.

CHECK OUT: Business expert says Netflix model leads to merger

Top Wall Street analyst

Needham and Co. aren’t the first to downgrade the stock to sell — it is the fourth. Yet, it was the weight of Laura Martin’s analysis that sent a shockwave into Netflix’s stock value.

On the 10th of December, there was a $9 drop; this was the day Martin downgraded the stock and said the following:

“‘We believe Netflix must add a second, lower priced, service to compete with Disney+, Apple+, Hulu, CBS All Access and Peacock, each of which have $5-$7/month choices,'” She argued that the company’s balance sheet wouldn’t be able to sustain lower revenue from this lower-priced tier so Netflix should consider adding six to eight minutes an hour of advertisements for this hypothetical tier priced at $5 to $7.”

Needham and Co. analyst Laura Martin

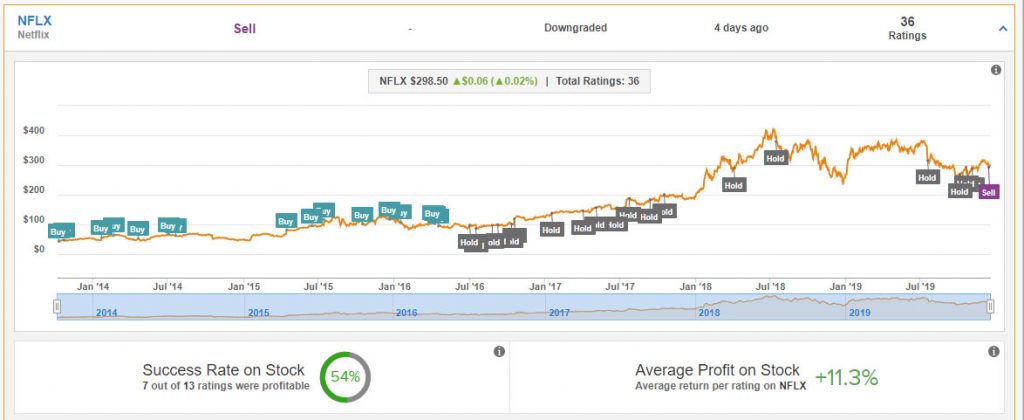

So who is Laura Martin? Well, she has a 64 percent success rate on TipRanks.com, with 195 tips out of 303 tips being profitable. Below is the analyst’s history with Netflix’s stock:

The downgrade and statement were made a day after Golden Globe nominations, where Netflix dominated. For the stock to drop and then climb on the 11th with a $5 gain shows resilience. However, the Martin shockwave is bound to have more ripples — despite her being wrong 46 percent of the time regarding Netflix.

CHECK OUT: Product placement and Netflix

SNIPdaily takeaway

We’re not Wall Street savvy, but we are streaming geeks. A loss of four million subscribers, if all on the highest tier, could cost Netflix a whopping $624 million. It is a significant amount, but Disney+ hit the market, accumulated 22 million subscribers and didn’t impact Netflix. So why will 2020 be different? To be blunt, there is plenty of entertainment money to go around, especially as people cut the cord on pay TV.

The big takeaway is that Netflix has spent $15 billion on content in 2019. They could half it and still be spending more than their competitors. They have the flexibility to cover lost subscribers, because four million from 151 million worldwide is something to reflect on rather than panic about.

Netflix knows the only thing that matters is content. If they keep producing, they keep giving people a reason to subscribe. They don’t need to adapt to the market — because they are the market.

CHECK OUT: Netflix spending 6 times more on content than Disney+